All Categories

Featured

Table of Contents

For the majority of people, the biggest issue with the limitless banking idea is that preliminary hit to very early liquidity triggered by the costs. This con of boundless banking can be minimized considerably with proper plan design, the very first years will certainly constantly be the worst years with any kind of Whole Life plan.

That claimed, there are specific boundless financial life insurance coverage policies designed mostly for high very early cash worth (HECV) of over 90% in the first year. Nonetheless, the long-term efficiency will usually considerably delay the best-performing Infinite Financial life insurance policy plans. Having access to that extra four figures in the initial couple of years might come with the price of 6-figures later on.

You really obtain some considerable lasting benefits that aid you recover these very early expenses and afterwards some. We find that this hindered early liquidity issue with limitless banking is more mental than anything else as soon as thoroughly explored. As a matter of fact, if they absolutely needed every penny of the cash missing from their unlimited financial life insurance plan in the first few years.

Tag: boundless financial concept In this episode, I chat concerning funds with Mary Jo Irmen who educates the Infinite Banking Principle. With the rise of TikTok as an information-sharing platform, economic suggestions and methods have actually discovered an unique means of spreading. One such approach that has been making the rounds is the limitless banking concept, or IBC for brief, garnering endorsements from stars like rapper Waka Flocka Flame.

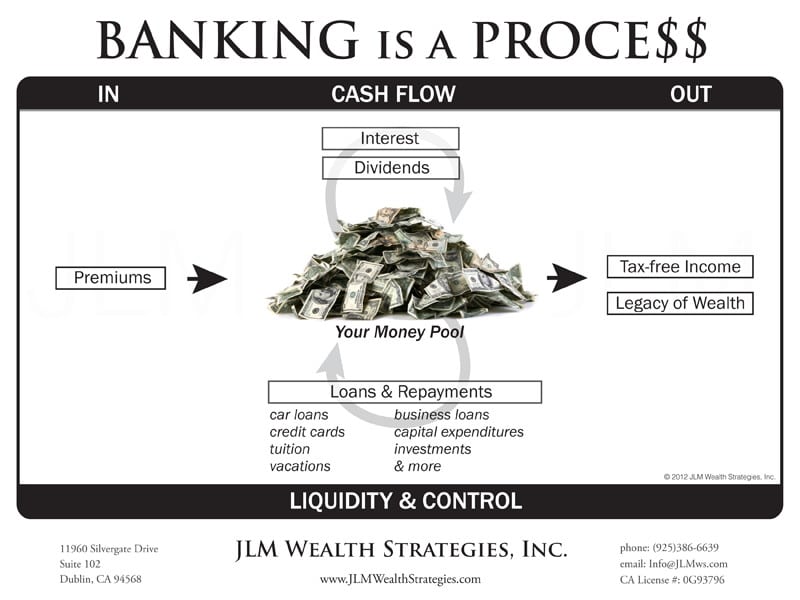

Within these plans, the cash money worth grows based upon a price established by the insurance company. Once a considerable cash money worth collects, insurance policy holders can obtain a cash worth funding. These fundings vary from conventional ones, with life insurance policy functioning as security, suggesting one can shed their insurance coverage if loaning excessively without ample cash money value to support the insurance expenses.

And while the appeal of these plans appears, there are innate restrictions and risks, necessitating diligent cash money value monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or entrepreneur, especially those using approaches like company-owned life insurance policy (COLI), the advantages of tax breaks and compound development could be appealing.

Nelson Nash Life Insurance

The appeal of infinite financial does not negate its challenges: Cost: The fundamental requirement, a permanent life insurance policy, is costlier than its term equivalents. Eligibility: Not everybody gets approved for entire life insurance policy because of strenuous underwriting procedures that can exclude those with particular wellness or way of life problems. Intricacy and threat: The elaborate nature of IBC, combined with its dangers, might discourage many, particularly when less complex and less high-risk alternatives are readily available.

Assigning around 10% of your regular monthly revenue to the plan is simply not practical for many people. Using life insurance policy as a financial investment and liquidity resource needs discipline and surveillance of policy money worth. Seek advice from an economic advisor to identify if limitless financial aligns with your concerns. Part of what you review below is merely a reiteration of what has actually already been claimed over.

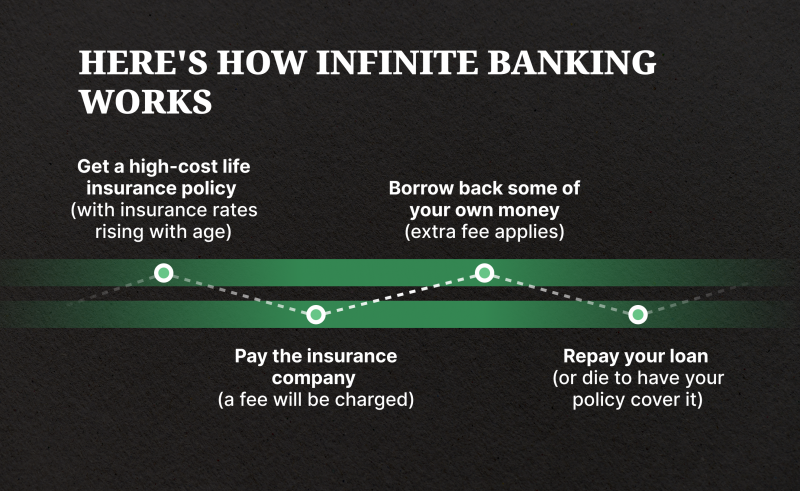

Before you obtain yourself right into a scenario you're not prepared for, recognize the complying with first: Although the idea is generally sold as such, you're not in fact taking a loan from yourself. If that were the situation, you wouldn't have to repay it. Instead, you're borrowing from the insurance coverage firm and need to settle it with rate of interest.

Some social media blog posts advise using cash worth from entire life insurance to pay down credit score card financial obligation. When you pay back the finance, a section of that rate of interest goes to the insurance coverage company.

For the first numerous years, you'll be paying off the commission. This makes it extremely challenging for your plan to gather value throughout this time. Unless you can afford to pay a couple of to a number of hundred bucks for the following years or more, IBC will not function for you.

How To Start Infinite Banking

If you call for life insurance policy, right here are some important tips to think about: Think about term life insurance coverage. Make certain to go shopping about for the ideal price.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Style Name "Montserrat". This Font Software is licensed under the SIL Open Up Typeface Permit, Version 1.1. Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Reserved Typeface Name "Montserrat". This Typeface Software program is licensed under the SIL Open Typeface Permit, Variation 1.1.Skip to primary content

Infinite Banking Powerpoint Presentations

As a CPA concentrating on property investing, I have actually cleaned shoulders with the "Infinite Banking Concept" (IBC) a lot more times than I can count. I have actually also interviewed experts on the subject. The major draw, besides the evident life insurance policy advantages, was always the idea of developing up money value within an irreversible life insurance coverage policy and loaning versus it.

Certain, that makes good sense. Truthfully, I always thought that money would certainly be better spent directly on financial investments instead than channeling it with a life insurance policy Till I found how IBC can be integrated with an Irrevocable Life Insurance Policy Trust Fund (ILIT) to develop generational riches. Let's start with the fundamentals.

Banker Life Quotes

When you borrow against your policy's cash money worth, there's no set repayment schedule, offering you the freedom to manage the car loan on your terms. On the other hand, the money worth remains to grow based upon the policy's assurances and dividends. This arrangement enables you to accessibility liquidity without disrupting the long-term growth of your plan, supplied that the financing and interest are managed sensibly.

The process proceeds with future generations. As grandchildren are birthed and expand up, the ILIT can buy life insurance policy policies on their lives. The trust fund then collects several plans, each with growing money values and survivor benefit. With these plans in position, the ILIT properly ends up being a "Household Bank." Family participants can take fundings from the ILIT, using the money value of the policies to money investments, start services, or cover significant expenditures.

A vital aspect of managing this Family Financial institution is the usage of the HEMS requirement, which represents "Health and wellness, Education, Maintenance, or Support." This standard is usually consisted of in count on contracts to direct the trustee on how they can disperse funds to beneficiaries. By adhering to the HEMS standard, the trust guarantees that circulations are made for vital requirements and long-lasting assistance, safeguarding the count on's properties while still offering for member of the family.

Increased Versatility: Unlike rigid small business loan, you manage the repayment terms when borrowing from your own plan. This permits you to framework repayments in a way that aligns with your business capital. nelson nash scam. Better Capital: By financing service costs via plan fundings, you can potentially maximize cash money that would otherwise be locked up in typical finance payments or tools leases

He has the same equipment, but has actually likewise constructed added cash money value in his plan and got tax advantages. And also, he now has $50,000 readily available in his policy to use for future possibilities or expenditures. In spite of its prospective advantages, some people continue to be skeptical of the Infinite Banking Concept. Allow's resolve a couple of usual worries: "Isn't this simply costly life insurance?" While it holds true that the premiums for an appropriately structured entire life policy might be more than term insurance coverage, it is very important to see it as greater than just life insurance policy.

Infinite Banking Concept Reviews

It has to do with creating an adaptable funding system that gives you control and provides multiple benefits. When utilized purposefully, it can enhance other financial investments and business strategies. If you're interested by the possibility of the Infinite Financial Concept for your company, below are some actions to consider: Enlighten Yourself: Dive much deeper right into the idea via credible publications, workshops, or examinations with educated experts.

Latest Posts

The First Step To Becoming Your Own Banker

Become Your Own Bank Book

Byob